CALGARY, March 20, 2023 – Crown Capital Partners Inc. (“Crown” or the “Corporation”) (TSX: CRWN) today announced its financial results for the three and 12 months ended December 31, 2022. Crown’s complete financial statements and management’s discussion and analysis are available on SEDAR at www.sedar.com.

2022 Financial & Operating Highlights

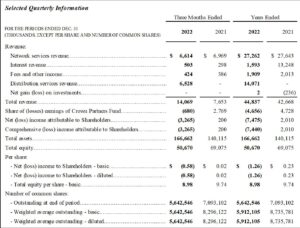

- Total revenue increased to $44.8 million, up from $42.7 million in 2021, primarily reflecting the addition of Distribution Services revenue following the acquisition of Go Direct Global in June 2022, and partially offset by substantially lower interest revenue resulting from the derecognition of Crown Partners Fund as a subsidiary in July 2021.

- Network Services revenue was $27.3 million in 2022, compared with $27.6 million in 2021, with growth in the enterprise-based revenues of Galaxy offset by a decline in the volume of revenue under contract with WireIE. This segment contributed net income before income taxes of $3.1 million, inclusive of depreciation and amortization expense totaling $3.9 million and $0.6 million of accrued decommissioning costs.

- Crown expanded and diversified its operations with the June 2022 acquisition of Go Direct Global, an e-commerce fulfillment and distribution services company. This business contributed revenue of $14.1 million in 2022 and a net loss before income taxes of $1.9 million, inclusive of depreciation and amortization expense totaling $1.9 million.

- Subsequent to being acquired by Crown, Go Direct Global added to its existing network by opening new facilities in Calgary, Alberta and Reno, Nevada.

- In 2022, Crown recognized a loss of $(4.7) million in relation to its investment in Crown Partners Fund (2021 – earnings of $4.7 million), including $(3.0) million in respect of its general partnership interest as a result of a reduction in the accrued performance bonus payable by the fund and $(1.7) million in respect of its limited partnership interest. The year-over-year decrease is primarily due to a provision for expected credit loss recognized in Q1 2022, which more than offset income from other investments of Crown Partners Fund and a resulting performance bonus recovery of $1.5 million.

- As previously disclosed, Crown Power Fund incurred total non-cash impairment charges of $3.6 million during Q3 2022, of which $1.6 million was attributable to Crown shareholders. This primarily reflects revised estimates of the recoverable value of a single distributed power project under development.

- Crown recognized a net loss of $7.5 million ($1.26 loss per basic share) in 2022, compared with net income of $2.0 million ($0.23 earnings per basic share) in the year ended December 31, 2021.

- Total equity at year-end decreased to $50.7 million, from $69.1 million at the end of 2021, reflecting share repurchases totaling $11.0 million and a net loss attributable to shareholders of $7.5 million. Total equity per share decreased to $8.98 per basic share from $9.74 as at December 31, 2021.

- Subsequent to year end, Crown entered an agreement for a new senior secured corporate credit facility of up to $43.5 million with Canadian Western Bank.

- Also subsequent to year end, Galaxy entered into a five-year purchase commitment with an aggregate value of US$50 million for the use of broadband network infrastructure with OneWeb to deliver low Earth orbit connectivity solutions across Canada.

Effective July 13, 2021, Crown began recognizing Crown Partners Fund as an investment in associate using the equity method rather than recognizing it as a subsidiary. As a result, many of our asset, liability, revenue and expense amounts as at and for the twelve months ended December 31, 2022 are not directly comparable to equivalent balances for the prior-year period.

“It was another eventful and successful year in the transformation of Crown to a capital-light company with two long-term growth platforms: network services and third-party fulfilment and distribution,” said Chris Johnson, President and CEO of Crown. “Both segments are making significant progress and are poised for profitable growth in 2023 and beyond based on recent contract wins and other expansion initiatives. We will continue to reduce our alternative lending exposure as the remaining loans mature and/or are repaid early. The resulting proceeds, in addition to our new credit facility, should provide us with the financial capacity to support organic and inorganic growth in our two main segments, as well as capital management priorities including additional share buybacks and management of the maturity of our debentures.”

Q4 2022 Financial Highlights

- Crown recognized a net loss of $(3.3) million ($0.58 loss per basic share) in Q4 2022, compared with net income of $0.2 million ($0.02 earnings per basic share) in Q4 2021.

- Our Network Services segment recognized a net loss before income taxes of $(0.4) million in Q4 2022, inclusive of depreciation and amortization expense totaling $0.9 million and $0.6 million of accrued decommissioning costs relating to the expected completion of certain network services contracts with WireIE in 2023. Seasonality in respect of certain parts of the Network Services business contributed to lower Network Services revenue in Q4 2022.

- Our Distribution Services segment recognized a net loss before income taxes of $(1.4) million in Q4 2022, inclusive of depreciation and amortization expense totaling $1.0 million. Most of this net loss is related to the operating facilities of Go Direct Global that are in various stages of achieving scale.

- Our share of losses of Crown Partners Fund in Q4 2022 was $(0.7) million, primarily due to the reduction in the estimated fair value of certain equity securities of Crown Partners Fund.

Q4 & FY2022 Financial Results Summary

Conference Call & Webcast

Crown will host a conference call and webcast to discuss its Q4 & Fiscal 2022 financial results at 11:30 a.m. ET on March 21, 2023. The call will be hosted by Chris Johnson, President & CEO, and Michael Overvelde, CFO. To participate in the call, dial (416) 764-8650 or (888) 664-6383 using the conference ID 44386563. The webcast can be accessed at www.crowncapital.ca under Investor Relations. Listeners should access the webcast or call 10-15 minutes before the start time to ensure they are connected.

About Crown Capital Partners (TSX:CRWN)

Founded in 2000 within Crown Life Insurance Company, Crown Capital Partners is a capital partner to entrepreneurs and growth businesses mainly operating in the telecommunications infrastructure, distribution services, and distributed power markets. We focus on growth industries that require a specialized capital partner, and we aim to create long-term value by acting as both a direct investor in operating businesses serving these markets and as a manager of investment funds for institutional partners. For additional information, please visit crowncapital.ca.

FORWARD-LOOKING STATEMENTS

This news release contains certain “forward looking statements” and certain “forward looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements in this news release include, but are not limited to, statements, management’s beliefs, expectations or intentions regarding the distribution services market, the network services market and the general economy, Crown’s business plans and strategy, including anticipated investment dispositions and capital deployments and the timing thereof, and Crown’s future earnings. Forward-looking statements are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors identified in the Crown’s periodic filings with Canadian securities regulators. See Crown’s most recent annual information form for a detailed discussion of the risk factors affecting Crown. In addition, Crown’s dividend policy will be reviewed from time to time in the context of the Corporation’s earnings, financial requirements for its operations, and other relevant factors and the declaration of a dividend will always be at the discretion of the board of directors of the Corporation. Crown undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

For further information, please contact:

Craig Armitage

Investor Relations

craig.armitage@crowncapital.ca

(416) 347-8954