CALGARY, May 5, 2020 – Crown Capital Partners Inc. (“Crown” or the “Corporation”) (TSX: CRWN), a capital partner to entrepreneurs and growth businesses, today announced its financial results for the first quarter ended March 31, 2020. Crown’s complete financial statements and management’s discussion and analysis for Q1 2020 are available on SEDAR at www.sedar.com.

Q1 2020 Financial & Operating Highlights

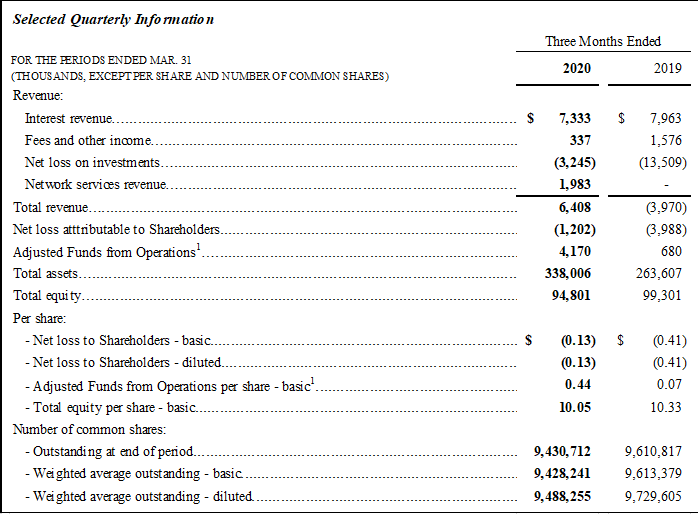

- Interest revenue was $7.3 million, compared with $8.0 million in Q1 2019.

- Total revenue increased to $6.4 million, compared with $(4.0) million in Q1 2019 due mainly to a significant decrease in the net loss on investments, from $(13.5) million in Q1 2019 to $(3.2) million in Q1 2020.

- Adjusted Funds from Operations1 increased to $4.2 million, representing the highest quarterly amount in the past eight quarters, compared with $0.7 million in Q1 2019.

- Net loss of $(1.2) million (Q1 2019 – net loss of $4.0 million), or $(0.13) per common share (basic) (Q1 2019 – net loss of $0.41 per share). The net loss for the current period mainly reflects a net unrealized loss on investments of $3.6 million from reductions in the fair values of investments of Crown Partners Fund.

- Total assets increased to $338.0 million at quarter-end, compared with $299.7 million at December 31, 2019, due mainly to new loan advances in the quarter.

- On March 27, 2020 Crown paid a quarterly dividend of $0.15 per common share.

- Crown Power Fund commenced construction on two new distributed power projects, increasing

the total number of projects in development or in operation to 11. - Crown Partners Fund advanced the remaining $6.1 million to VIQ Solutions available under the $15.0 million loan facility established in 2018.

- Crown Partners Fund announced two transactions for up to $35.5 million:

- A five-year term loan of up to $30 million to Centric Health Corporation, of which $22 million has been advanced.

- A two-year, $5.5 million term loan with CCI Wireless.

“Since our fiscal 2019 results were announced in March, we have adapted our operations to address the COVID-19 pandemic. Our business continuity plan enabled us to seamlessly operate from remote locations and ensure the health and safety of the team,” said Chris Johnson, President and CEO of Crown. “This is a rapidly evolving environment which creates considerable uncertainty for Crown and our borrowers. While we expect most companies will be affected to some degree and will be required to adapt, the portfolio is currently in stable condition overall and we remain highly diligent in our portfolio management. There is an ‘all-weather’ aspect to our investment strategy that served us well through the 2008 global financial crisis.”

“Crown’s management team has extensive experience analyzing and assessing value of businesses of all types. We believe that the public markets are not reflecting a fair value for Crown’s business and do not provide ready access to capital,” added Mr. Johnson. “In addition to the structural challenges facing almost all small-cap companies, alternative lenders are trading at persistently high discounts to their underlying asset values. Over a 4-year period, Crown has traded at an average price-to-book multiple of 0.85 times, a 15% discount. Currently Crown’s common shares currently trade at less than 50% of its $10.05 book value as at March 31, 2020. The status quo is not acceptable and while this is not a new realization for our management team, the current environment has led us to accelerate a repositioning of the Corporation’s balance sheet to be more capital efficient.”

“As we undergo this transition, we’ve made the decision to suspend shareholder dividends. Our focus is on increasing earnings per share over the medium to long term, and we believe in light of the current market realities, funds available for distribution will be more impactful for shareholders to be used for strategic investments and share buybacks.”

“We’re optimistic about the future. While we expect a significant and sustained economic recession, past experience suggests economic crisis creates opportunity for alternative finance providers. Quality businesses need capital and traditional providers often retreat in times of uncertainty. Additionally, our team strongly believes that through the repositioning of the balance sheet described below, we will emerge as a much more profitable, diversified finance platform with a larger market opportunity.”

Update on Operations

Alternative Corporate Financing Investments

At March 31, 2020, our Alternative Corporate Financing investments stood at $275.4 million, including Special Situations Financing investments of $240.4 million and Long-Term Financing investments of $35.0 million. Our Special Situations Financing investments are managed through Crown Partners Fund, in which Crown holds an approximate 39% interest.

We are actively monitoring the impact of the COVID-19 pandemic and the related economic impacts on the health of our portfolio companies. The current environment is a rapidly evolving situation which creates uncertainty for us and our borrowers. All our portfolio companies will be affected with some of them being forced to take aggressive measures to adapt. The duration and impact of this pandemic are unknown at this time, and the longer the situation continues, the more uncertainty there will be regarding the business, operations, financial condition and/or underlying security value of our borrowers. We presently believe the impacts of the current situation will not result in the failure of any of our borrowers and will likely have only a minimal impact on their ability to make payments to Crown. In addition, while there is increased volatility in global oil markets, Crown’s energy clients have substantial natural gas exposure, which is expected to provide a measure of stability to these companies.

We believe the market instability caused by the COVID-19 pandemic will result in a further weakening of the credit cycle and, ultimately, a net increase in investment opportunities in our Special Situations Financing segment when corporate lending transaction activity returns to normal levels. We continue to believe Crown Partners Fund will grow to $500 million in assets over time.

Distributed Power Investments

In our distributed power business, we remain focused on building assets in the Crown Power Fund and securing additional third-party funding commitments in the Crown Power Fund to finance additional projects. We do not presently see any material financial impacts of the COVID-19 pandemic on the financial performance of our power generation assets or opportunities. Rather, we expect that 2020 will be a year of accelerated growth. The pipeline of potential transactions, including prospective projects already in the planning stage, is vibrant and growing. We currently have ten power projects in development and one in operation. We expect these projects will increase revenue and operating cash flow to Crown Power Fund as they become operational in 2020. We also continue to build our base of operating partners. In March 2020, Crown Power Fund established a relationship with, and partial ownership in, an operating partner with a focus on providing distributed power solutions to the midstream energy sector in Alberta. Crown Power Fund now has six operating partners.

Crown’s Financial Position

While our fiscal 2019 earnings were affected by two anomalous events previously disclosed in our public filings, we continue to deliver budgeted Adjusted Funds from Operations (see definition under “Q1 2020 Financial Results Summary”), which we consider the best measure in assessing the cash generated by our business. We have a $35 million revolving line of credit with ATB Financial and Business Development Bank of Canada, of which we have currently drawn approximately $30 million. We believe Crown is modestly leveraged with debt representing roughly 27% of total assets, when we include our $20 million outstanding convertible debenture and the outstanding debt of Crown Partners Fund. We have no maturities until May 2021.

We continue to have capital available to fund opportunities as they arise. Crown has access to up to $97 million to fund additional investments, including our working capital, committed capital from third parties, and undrawn amounts available under our credit facilities. We will also be pursuing additional capital from limited partner investors in both our special situations and distributed power funds in the near term.

Strategic Update

In response to Crown trading at a persistent discount to our underlying net asset value, we have been working to evolve our strategy and diversify our business. We have two main priorities:

- Develop new revenue streams that are both highly profitable and scalable where Crown can act both as a direct investor and asset manager of capital pools, such as distributed power; and

- Improve the efficiency of our use of capital by shifting to a capital-light business model. Our Alternative Corporate Financing investments, while they generate healthy interest income, are not being valued properly by the public markets. Capital is valuable and requires strategic purpose such as seeding new funds or lines of business. The vast majority of the funds required to grow can and should come from third parties who have a lower cost of capital than Crown.

Consistent with our plan to increase capital efficiency, we expect to lower our ownership position in Crown Partners Fund toward a target of 20% or less, from 39% currently. In addition, we are in the process of realization, at least in part, of our existing Long-term Financing investments. The proceeds from realizations will be used to pursue strategic opportunities and rationalize our capital structure. While we expect the unwinding and divestment of a portion of our Alternative Corporate Financing investments will create some near-term earnings volatility, we see this as necessary to effect the shift to a more capital-efficient business.

Suspension of Dividend

In 2019, we paid out to shareholders a total of $7.5 million, comprising $5.7 million of dividends and $1.8 million of share buybacks. In 2020, we expect to generate positive Adjusted Funds from Operations and to generate proceeds from realized investments, however, as we transition our business to be more capital efficient we will be suspending dividends. Our overriding objective is to achieve increased shareholder value and we believe that directing available funds to strategic opportunities and share buybacks, including our recently renewed Normal Course Issuer Bid program, will achieve higher shareholder returns than distribution of dividends.

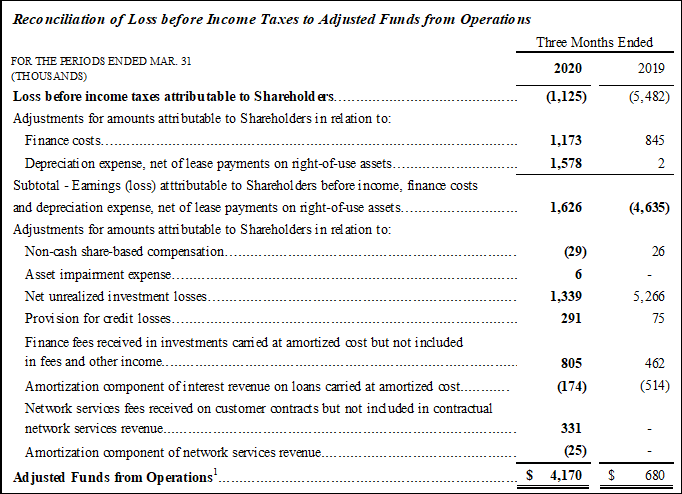

Q1 2020 Financial Results Summary

1 Adjusted Funds from Operations is not a measure of financial performance (nor does it have a standardized meaning) under IFRS. In evaluating this measure, investors should consider that the methodology applied in calculating these measures might differ among companies and analysts. The Corporation has provided a reconciliation of loss before income taxes to Adjusted Funds from Operations in this news release. We believe that Adjusted Funds from Operations is a useful supplemental measure in the context of Crown’s specialty finance focus to assist investors in assessing the cash anticipated to be generated by Crown’s business, including cash received in relation to its various revenue streams, that is attributable to Shareholders. Adjusted Funds from Operations should not be considered as the sole measure of Crown’s performance and should not be considered in isolation from, or as a substitute for, analysis of the Corporation’s financial statements.

Conference Call & Webcast

Crown will host a conference call to discuss its Q1 2020 financial results at 8:30 a.m. EDT on May 5, 2020. The call will be hosted by Chris Johnson, President & CEO, and Michael Overvelde, CFO. To participate in the call, dial (416) 764-8659 or (888) 664-6392 using the conference ID 37927017. The audio webcast can be accessed at www.crowncapital.ca under Investor Relations or https://bit.ly/3cPBnQD. Listeners should access the webcast or call 10-15 minutes before the start time to ensure they are connected.

About Crown Capital Partners (TSX:CRWN)

Founded in 2000, Crown is a leading specialty finance company that provides growth capital to a diversified group of successful mid-market companies that are seeking alternatives to banks and private equity funds. Crown provides customized solutions in the form of loans, royalties, and other structures with minimal or no ownership dilution. In addition to deploying capital as a principal investor, Crown develops, manages and co-invests in alternative investment funds, including Crown Partners Fund and Crown Capital Power Fund.

FORWARD-LOOKING STATEMENTS

This news release contains certain “forward looking statements” and certain “forward looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements in this news release include, but are not limited to, statements, management’s beliefs, expectations or intentions regarding the alternative financial market and the general economy, transaction pipeline, Crown’s business plans and strategy, including anticipated capital deployments and the timing thereof, and Crown’s future earnings. Forward-looking statements are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors identified in the Crown’s periodic filings with Canadian securities regulators. See Crown’s most recent annual information form for a detailed discussion of the risk factors affecting Crown. In addition, Crown’s dividend policy will be reviewed from time to time in the context of the Corporation’s earnings, financial requirements for its operations, and other relevant factors and the declaration of a dividend will always be at the discretion of the board of directors of the Corporation. Crown undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

For further information, please contact:

Craig Armitage

Investor Relations

craig.armitage@crowncapital.ca

(416) 347-8954