CALGARY, August 12, 2020 – Crown Capital Partners Inc. (“Crown” or the “Corporation”) (TSX: CRWN), a capital partner to entrepreneurs and growth businesses, today announced its financial results for the second quarter ended June 30, 2020. Crown’s complete financial statements and management’s discussion and analysis for Q2 2020 are available on SEDAR at www.sedar.com.

Q2 2020 Financial & Operating Highlights

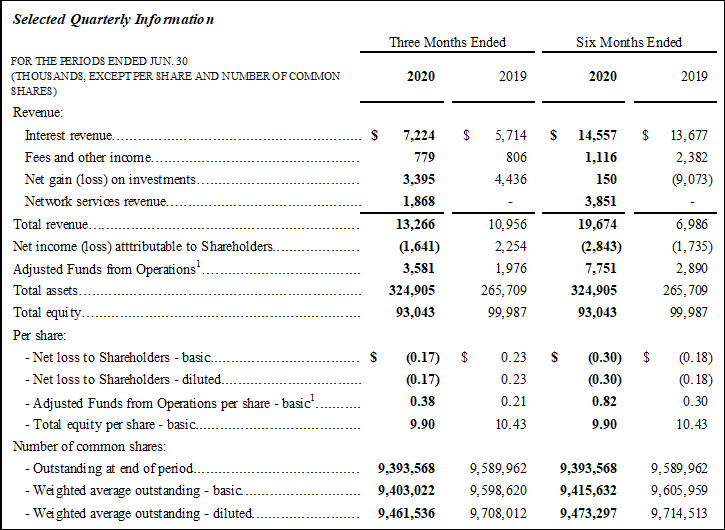

- Total revenue increased 21% to $13.3 million from $11.0 million in Q2 2019, due mainly to increased interest revenue and the addition of the network services business.

- Interest revenue was $7.2 million, up 26% compared with $5.7 million in Q2 2019, reflecting the growth of Crown Partners Fund and initial contributions from Crown Power Fund, offset by lower interest revenue from on balance sheet investments.

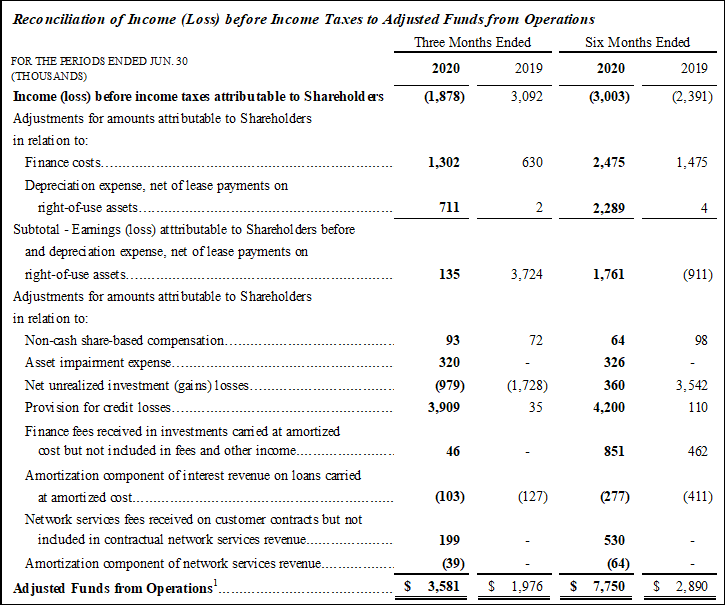

- Adjusted Funds from Operations1 increased to $3.6 million, up 81% from $2.0 million in Q2 2019.

- Net loss of $(1.6) million (Q2 2019 – net income of $2.3 million), or $(0.17) per common share (basic) (Q2 2019 – net income of $0.23 per share). The net loss for the current period mainly reflects a provision for credit losses of $3.9 million that is primarily in respect of the loan in PenEquity Realty Corp.

- Total assets increased to $324.9 million at quarter-end, compared with $299.7 million at December 31, 2019, due mainly to net additions to each of investments and distributed power equipment under development.

- Total equity as at June 30, 2020 was $93.0 million, or $9.90 per basic share.

- Crown Power Fund established a new relationship with a seventh operating partner which is primarily focused on providing distributed power solutions to commercial end users in Eastern Canada.

- Crown Partners Fund advanced an additional $5.0 million to CareRx (formerly Centric Health Corporation) under its $30.0 million loan commitment, increasing this loan to $27.0 million.

- Crown Partners Fund received early repayment by Touchstone Exploration of a $20.0 million special situations loan.

- Under its Normal Course Issuer Bid, Crown acquired and cancelled 38,698 shares in the second quarter.

“Consistent with the strategic priorities we outlined in Q1 2020, our team is working diligently to expand our investment platforms – Alternative Corporate Financing, Distributed Power and Network Services – while we are beginning the difficult but necessary work to reposition our balance sheet and transition to a capital-light business,” said Chris Johnson, President and CEO of Crown. “Our focus on downside protection has served us well during past downturns and, now five months into the COVID-19 pandemic, our investment portfolio is currently in stable condition overall. Although the broader economic outlook appears challenging, we believe we are likely entering a strong cycle for our key lines of business, and we plan to expand our fund management business to capitalize on this expected growth.”

Update on Operations

Alternative Corporate Financing Investments

At June 30, 2020, our Alternative Corporate Financing investments stood at $264.6 million, including Special Situations Financing investments of $227.5 million and Long-Term Financing investments of $37.1 million. Our Special Situations Financing investments are managed through Crown Partners Fund, in which Crown holds an approximate 39% interest.

We continue to actively monitor the impact of the COVID-19 pandemic and the related economic impacts on the health of our portfolio companies. We expect all our portfolio companies will be affected to some degree. The duration and impact of this pandemic are unknown at this time, and the longer the situation continues, the more uncertainty there will be regarding the business, operations, financial condition and/or underlying security value of our borrowers. We presently believe the impacts of the current situation will not result in the failure of any of our borrowers, although we will likely have to financially restructure a small number of our portfolio companies to address over-leveraged balance sheets.

Consistent with our plan to increase capital efficiency, we expect to reduce our ownership position in Crown Partners Fund toward a target of 20% or less, from 39% currently. In addition, we are in the process of realization, at least in part, of our two Long-term Financing investments. The proceeds from realizations will be used to pursue strategic opportunities and rationalize our capital structure.

Distributed Power Investments

In our distributed power business, our priorities for 2020 include building assets in the Crown Power Fund and securing additional third-party funding commitments to finance additional projects. We presently see only minimal financial impacts of the COVID-19 pandemic on the financial performance of our power generation assets or opportunities. The pipeline of potential transactions, including prospective projects already in the planning stage, is growing and now stands at approximately $200 million, and we continue to build our base of operating partners, with seven developers now involved. In June 2020, Crown Power Fund established a relationship with, and partial ownership in, an additional third-party operating partner focused on Eastern Canada.

Crown is pursuing additional capital from limited partner investors in both our special situations and distributed power funds in the near term.

Q2 2020 Financial Results Summary

1 Adjusted Funds from Operations is not a measure of financial performance (nor does it have a standardized meaning) under IFRS. In evaluating this measure, investors should consider that the methodology applied in calculating these measures might differ among companies and analysts. The Corporation has provided a reconciliation of loss before income taxes to Adjusted Funds from Operations in this news release. We believe that Adjusted Funds from Operations is a useful supplemental measure in the context of Crown’s specialty finance focus to assist investors in assessing the cash anticipated to be generated by Crown’s business, including cash received in relation to its various revenue streams, that is attributable to Shareholders. Adjusted Funds from Operations should not be considered as the sole measure of Crown’s performance and should not be considered in isolation from, or as a substitute for, analysis of the Corporation’s financial statements.

Conference Call & Webcast

Crown will host a conference call and webcast (with slide presentation) to discuss its Q2 2020 financial results at 8:30 a.m. EDT on August 12, 2020. The call will be hosted by Chris Johnson, President & CEO, and Michael Overvelde, CFO. To participate in the call, dial (416) 764-8659 or (888) 664-6392 using the conference ID 12863040. The webcast can be accessed at www.crowncapital.ca under Investor Relations or https://bit.ly/2Dg1cwy. Listeners should access the webcast or call 10-15 minutes before the start time to ensure they are connected.

About Crown Capital Partners (TSX:CRWN)

Founded in 2000, Crown is a leading specialty finance company that provides growth capital to a diversified group of successful mid-market companies that are seeking alternatives to banks and private equity funds. Crown provides customized solutions in the form of loans, royalties, and other structures with minimal or no ownership dilution. In addition to deploying capital as a principal investor, Crown develops, manages and co-invests in alternative investment funds, including Crown Partners Fund and Crown Capital Power Fund.

FORWARD-LOOKING STATEMENTS

This news release contains certain “forward looking statements” and certain “forward looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements in this news release include, but are not limited to, statements, management’s beliefs, expectations or intentions regarding the alternative financial market and the general economy, transaction pipeline, Crown’s business plans and strategy, including anticipated capital deployments and the timing thereof, and Crown’s future earnings. Forward-looking statements are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors identified in the Crown’s periodic filings with Canadian securities regulators. See Crown’s most recent annual information form for a detailed discussion of the risk factors affecting Crown. In addition, Crown’s dividend policy will be reviewed from time to time in the context of the Corporation’s earnings, financial requirements for its operations, and other relevant factors and the declaration of a dividend will always be at the discretion of the board of directors of the Corporation. Crown undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

For further information, please contact:

|