CALGARY, November 11, 2020 – Crown Capital Partners Inc. (“Crown” or the “Corporation”) (TSX: CRWN), a capital partner to entrepreneurs and growth businesses, today announced its financial results for the third quarter ended September 30, 2020. Crown’s complete financial statements and management’s discussion and analysis for Q3 2020 are available on SEDAR at www.sedar.com.

Q3 2020 Financial & Operating Highlights

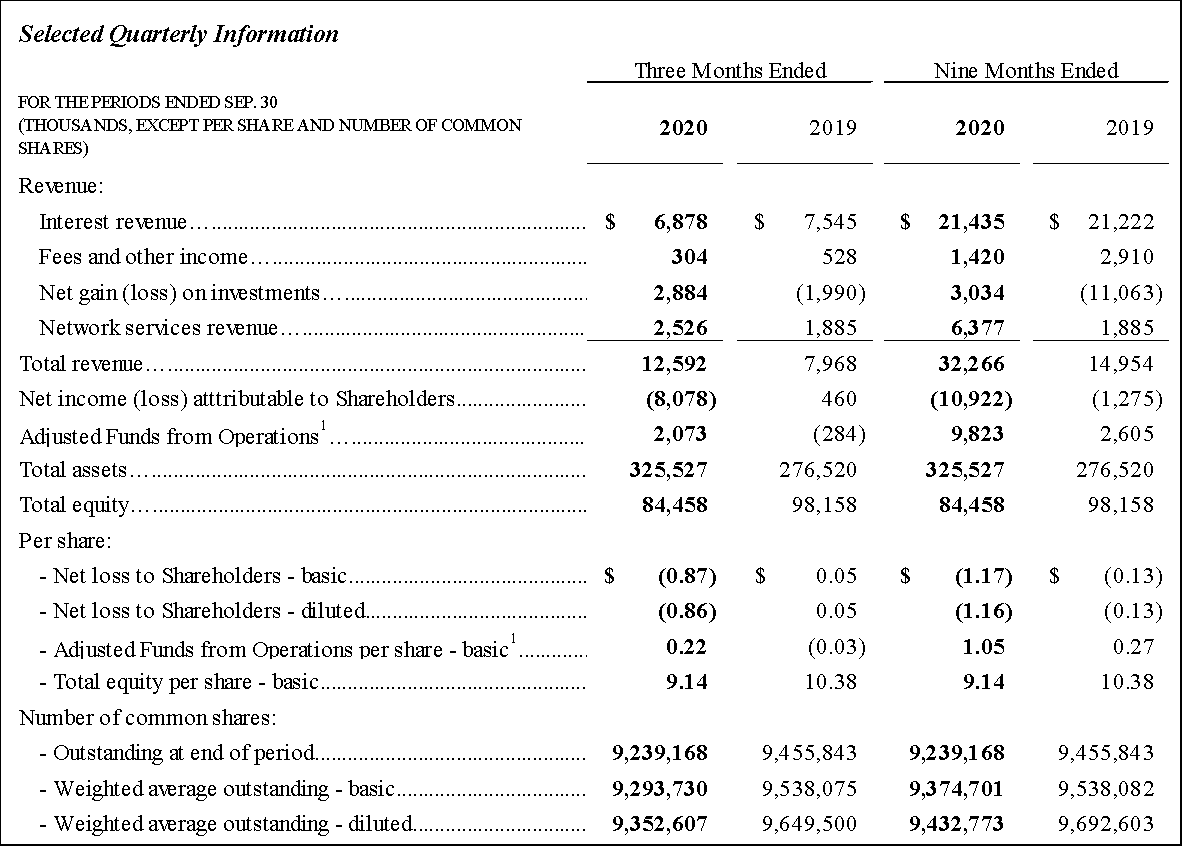

- Total revenue increased to $12.6 million from $8.0 million in Q3 2019, due mainly to higher net gains (losses) on investments in the current period and higher network services revenue.

- Interest revenue totaled $6.9 million, compared with $7.5 million in Q3 2019. Higher interest revenue earned by Crown Partners Fund and Crown Power Fund was offset by lower interest revenue from Crown’s on balance sheet investments.

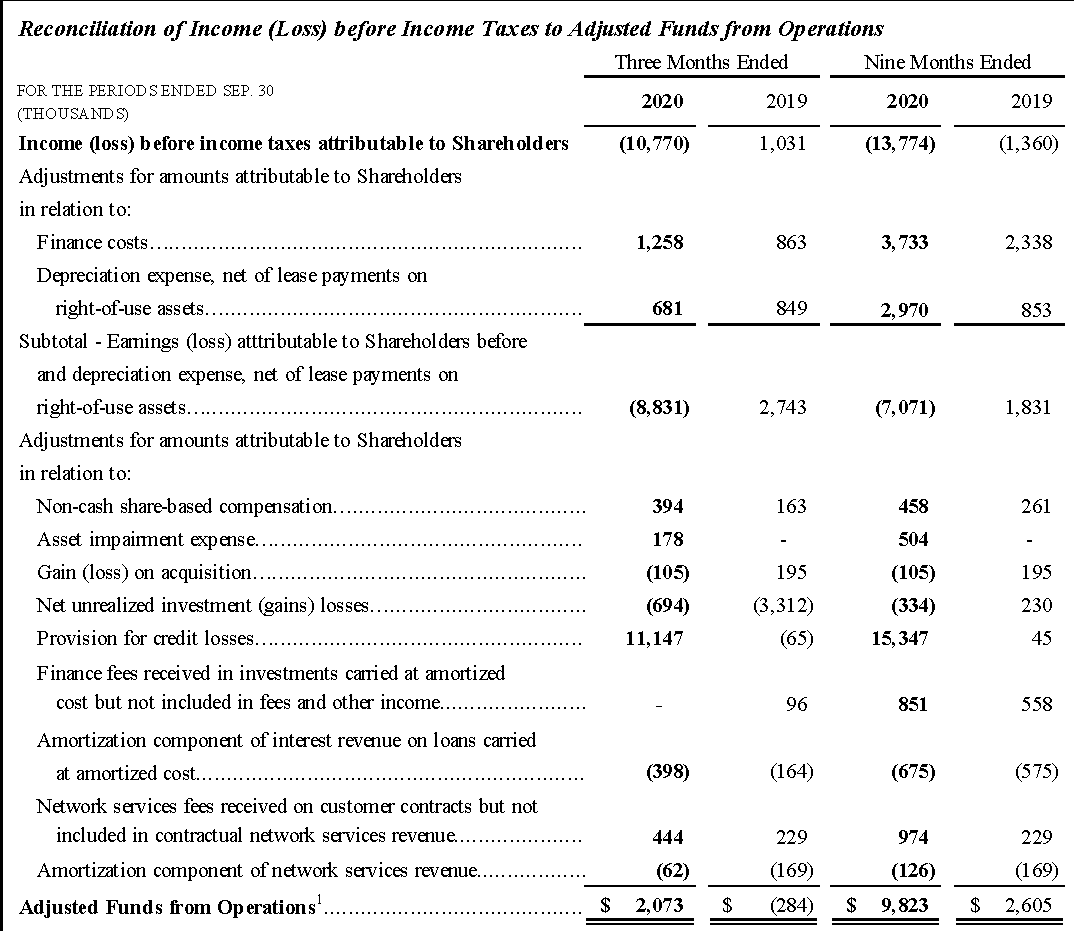

- Adjusted Funds from Operations1 increased to $2.1 million, from $(0.3) million in Q3 2019.

- Net loss of $(8.1) million (Q3 2019 – net income of $0.5 million), or $(0.87) per common share (basic) (Q3 2019 – net income of $0.05 per share).

- The net loss for the current period mainly reflects a $11.2 million provision for credit loss related to the loan in PenEquity Realty Corp., due primarily to a reduction in the collateral value of two of PenEquity’s three main development properties.

- Net investment gains of $2.9 million were recognized (Q3 2019 – net investment loss of $2.0 million) including net unrealized gains of $3.6 million by Crown Partners Fund on its special situations investments.

- Total assets increased to $325.5 million at quarter-end, compared with $299.7 million at December 31, 2019, due mainly to additional investment in distributed power equipment under development and a higher cash balance ($17.9 million).

- Total equity as at September 30, 2020 decreased to $84.5 million, or $9.14 per basic share, mainly reflecting the provision for credit losses.

- Crown Power Fund established a relationship with, and partial ownership in, an eighth operating partner that is focused on providing distributed power solutions on sustainable power projects to commercial end users across North America.

- Expanded Network Services platform with the acquisition Galaxy Broadband Communications, an Ontario-based network services company that provides connectivity to remote and underserviced enterprise customers across Canada.

- Crown received a partial repayment of $7.0 million in respect of its $10.0 million term loan to Mill Street & Co. Inc., and subsequent to September 30, 2020, Crown Partners Fund received early repayment by CCI Wireless of a $5.5 million special situations loan.

- Consistent with Crown’s plan to rationalize its capital structure, the Company acquired and cancelled 154,400 shares in the third quarter and 193,098 in the fiscal year to date under its Normal Course Issuer Bid.

“In the third quarter, we made further progress on the strategic priorities we outlined earlier in the year, including transitioning to a capital-light business,” said Chris Johnson, President and CEO of Crown. “We continued to reduce our lending portfolio and return capital to shareholders through the increased use of our normal course issuer bid. While the investment portfolio has generally performed well through the difficult economic conditions in 2020, unfortunately we had to take a sizeable loan loss provision on our PenEquity loan. Their business was affected by the sudden and severe impact to the retail environment as a result of COVID-19, which caused us to reduce our assessment of the value of two of their main development properties. Over the course of this 4-year loan, we received roughly 40% of our capital back through interest payments, and we will work diligently towards recovering the remainder of our investment. We see a reasonable path to achieving that over time.”

“In addition to repositioning Crown’s balance sheet, we are focused on developing new revenue streams across all three investment platforms – Alternative Corporate Financing, Distributed Power and Network Services –where Crown can act both as a direct investor and asset manager of capital pools. In Crown Power Fund, we added an 8th operating partner in the third quarter, which will help us further build on the project pipeline that now stands at approximately $250 million. Another key highlight in the quarter was the acquisition of Galaxy – our second acquisition in Network Services. When combined with our existing WireIE operations, we move forward with additional scale and deeper technology and go-to-market capabilities to target the growing need for broadband connectivity to remote locations.”

Q3 2020 Financial Results Summary

1 Adjusted Funds from Operations is not a measure of financial performance (nor does it have a standardized meaning) under IFRS. In evaluating this measure, investors should consider that the methodology applied in calculating these measures might differ among companies and analysts. The Corporation has provided a reconciliation of loss before income taxes to Adjusted Funds from Operations in this news release. We believe that Adjusted Funds from Operations is a useful supplemental measure in the context of Crown’s specialty finance focus to assist investors in assessing the cash anticipated to be generated by Crown’s business, including cash received in relation to its various revenue streams, that is attributable to Shareholders. Adjusted Funds from Operations should not be considered as the sole measure of Crown’s performance and should not be considered in isolation from, or as a substitute for, analysis of the Corporation’s financial statements.

Conference Call & Webcast

Crown will host a conference call and webcast (with slide presentation) to discuss its Q3 2020 financial results at 8:30 a.m. EDT on November 11, 2020. The call will be hosted by Chris Johnson, President & CEO, and Michael Overvelde, CFO. To participate in the call, dial (416) 764-8659 or (888) 664-6392 using the conference ID 18516448. The webcast can be accessed at www.crowncapital.ca under Investor Relations or this link. Listeners should access the webcast or call 10-15 minutes before the start time to ensure they are connected.

About Crown Capital Partners (TSX:CRWN)

Founded in 2000, Crown is a leading specialty finance company that provides growth capital to a diversified group of successful mid-market companies that are seeking alternatives to banks and private equity funds. Crown provides customized solutions in the form of loans, royalties, and other structures with minimal or no ownership dilution. In addition to deploying capital as a principal investor, Crown develops, manages and co-invests in alternative investment funds, including Crown Partners Fund and Crown Capital Power Fund.

FORWARD-LOOKING STATEMENTS

This news release contains certain “forward looking statements” and certain “forward looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements in this news release include, but are not limited to, statements, management’s beliefs, expectations or intentions regarding the alternative financial market and the general economy, transaction pipeline, Crown’s business plans and strategy, including anticipated capital deployments and the timing thereof, and Crown’s future earnings. Forward-looking statements are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors identified in the Crown’s periodic filings with Canadian securities regulators. See Crown’s most recent annual information form for a detailed discussion of the risk factors affecting Crown. In addition, Crown’s dividend policy will be reviewed from time to time in the context of the Corporation’s earnings, financial requirements for its operations, and other relevant factors and the declaration of a dividend will always be at the discretion of the board of directors of the Corporation. Crown undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

For further information, please contact:

Craig Armitage

Investor Relations

craig.armitage@crowncapital.ca

(416) 347-8954